While it’s been nearly a year since New Jersey voters passed a referendum to legalize cannabis in their state, it was not until last month that regulators came together to establish the initial rules for an emerging marijuana retail industry.

After spending time taking considerations from the public, the state aims to develop a cannabis market that is prioritized on safety and equity, focused on legalizing the plant in a way that will repair the harms created by the war on drugs and provide opportunities for people of all backgrounds to participate.

But how exactly will the legal landscape of adult-use cannabis look in the state? Check out this guide to learn everything you need to know about cannabis legislation in New Jersey!

Current Legislations

There are currently three bills signed into law that set the rules and regulations for New Jersey’s legal cannabis industry.

- Bill A1897. Reforms the criminal penalties for the possession of 10 grams or less of marijuana and regulated marijuana-infused products.

- Bill A5324. Revises consequences for underage possession or consumption of various forms of cannabis.

- Bill A21. Also known as the Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization (CREAMM) Act, is the law authorizing the Cannabis Regulatory Commission to expand and further develop the state’s Medicinal Cannabis Program, as well as develop, regulate, and enforce the rules and activities associated with recreational cannabis.

The CREAMM Act for Cannabis Entrepreneurs

For those looking to open a cannabis business in New Jersey, the CREAMM Act is the most important law to become familiar with, as it answers all of the essential questions surrounding the requirements, licensing, and costs associated with starting a dispensary or cannabis retail operation.

Here are a few key points that the bill makes on the eventual introduction of recreational cannabis business:

Municipal Requirements

The CREAMM authorizes local municipalities to enact ordinances or regulations controlling the number of cannabis establishments within their borders. Each city, town, township, village, or borough is responsible for establishing its own rules for approving cannabis licenses in the jurisdiction. Cannabis delivery, however, cannot be prohibited in any municipality.

Microbusinesses

Microbusinesses are essentially any cannabis business operating with less than 10 employees in a facility smaller than 2500 square feet, possessing less than 1,000 lbs of cannabis material. These enterprises were established to create easier entry and greater competition within the market, as the application and operating fees are only a fraction of those a standard business would pay.

Establishes Limitation of Cannabis Licenses

The bill also established certain restrictions on cannabis licenses, announcing that only 37 Class 1 Cannabis Cultivators will be allowed until February 2023. There will also be a ban on vertical integration, meaning no single business can grow, produce, and sell cannabis (with the exception of expanded alternative treatment centers).

Getting a Cannabis License in NJ

On August 19th, the CRC established six classes of licenses for recreational cannabis businesses. The application period for licensing is yet to be announced, but you can stay updated by monitoring the Cannabis Regulatory Commission website.

- Cannabis Cultivator. Growing recreational cannabis.

- Cannabis Manufacturer. Producing recreational use of cannabis.

- Cannabis Wholesaler. Storing, selling or transferring recreational use cannabis items between cannabis cultivators, wholesalers, or retailers.

- Cannabis Distributor. Transporting cannabis items in bulk between cannabis cultivators, manufacturers, or retailers within the state of New Jersey.

- Cannabis Retailer. Purchasing recreational use cannabis from licensed cultivators, manufacturers, or wholesalers to sell to consumers in a retail store.

- Cannabis Delivery. Transporting already purchased recreational use cannabis and related supplies from a retailer to the consumer.

Applicants are also eligible to receive a temporary conditional permit, which allows a business to operate while they work towards meeting the requirements for a full license.

Application and Operating Fees

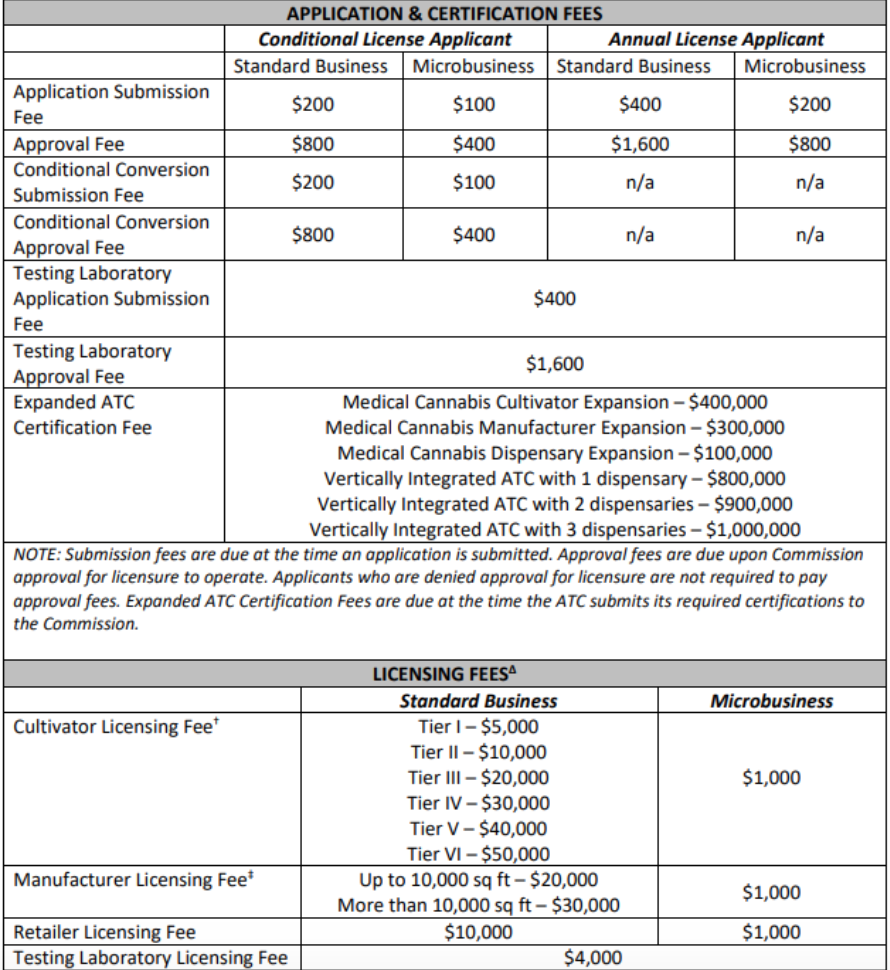

Here is the full breakdown of required fees for certifying your cannabis business in NJ:

In addition to these fees, applicants will need to provide detailed information on the ins and outs of their business through a five-year financial forecast that includes projected annual revenues, operating expenses, costs, and net profit, as well as employee information.

If you are preparing to apply and are worried about adhering to the state’s compliance laws, our team of experienced accountants can help!

How Cannabis Will Be Taxed

Under the CREAMM Act, there will be a consumer sales tax of 7% placed on all sales of cannabis, and dispensary owners will pay an amount per ounce that increases as the average price drops over time.

Price of Cannabis (Ounce) | Tax Rate |

$350+ | $10/oz |

$350-$250 | $30/oz |

$250-$200 | $40/oz |

$200-$0 | $60/oz |

As far as tax revenue allocation goes, 70% will be put towards repairing the damage done by the war on drugs, and the remaining 30% will support the state’s cannabis regulatory agency and infrastructure.

Bottom Line

This is an exciting time for cannabis in New Jersey, with many hopeful entrepreneurs looking to get in on the action. If you’re looking to open a dispensary, Green Space Accounting can help you every step of the way, ensuring that your business will operate efficiently, compliantly and profitably.

Check out our website to see a full list of services, and book a consultation today!

Cannabis Real Estate Financing: Securing The Right Property For Your Business

Cannabis real estate financing can seem daunting if you haven’t dealt with it before. However, conducting the right protocols for getting proper real estate financing

Maryland Accounting Services For Cannabis Businesses

Cannabis businesses are always in need of Maryland accounting services, but what should they look for in an accountant? Many are around the Maryland area

Cannabis CPA Near Me: Finding The Right Accountant For Your Cannabis Business

Finding the right CPA is about knowing what to look for. There are dozens around Maryland, and it can be challenging to choose the best

How The Best Cannabis Tax Filing Experts Help Cannabis Businesses Grow

Cannabis businesses can succeed and grow with the right tax help. Tax filing experts are great for getting companies to prepare for tax season, file

Cannabis Business Finances: A Guide To Budgeting Setting And Forecasting

Mastering budgeting setting and forecasting for your cannabis business can allow you to stay prepared for oncoming regulatory fees or other unexpected finances. Cannabis businesses

Mastering Cannabis Inventory Audits: A Step-By-Step Approach

A cannabis inventory audit can grow your operations by preventing losses from theft or mismanagement, streamlining the inventory process by identifying obsolete stock, and much