Do you want to find more financial options and are seeking solutions to the lack of financial services your dispensary does not get? Luckily, there is a way around the dynamic shift of financial regulations within the cannabis industry.

As you know, dispensaries like yours have restrictive financial options and work in cash-only transactions. It is a tremendous problem to overcome that can force you to think creatively.

But as cannabis accountants, we understand the challenges of getting financial services for your dispensary.

This guide goes more in-depth on finding financial services in Maryland for dispensaries like yours and ways to combat financial restrictions.

How Dispensaries Face Financial Problems In Maryland

Dispensaries are left with very few financial options from banking institutions, which leads to them operating in cash transactions for every sale.

Though many licensing applications are being set forth to allow the recreational use of cannabis, there is little room for banks to work with cannabis dispensaries.

There’s also an imposed 9% tax rate for every cannabis product sold in Maryland, as set forth by the Maryland Cannabis Administration and other legal authorities.

Since cannabis is scheduled as a drug under the Controlled Substance Act, financial banks don’t seek to get into trouble by working with dispensaries.

However, if the Cannabis Safe Banking Act comes to fruition, many banks may be protected from working with cannabis companies.

Time can only tell as the industry evolves with new regulations occurring on the market.

Combating Restrictive Financial Services In Maryland

Now you may wonder how to combat these restrictive financial services in Maryland for your dispensary to operate smoothly. There are some ways you can operate your business without worrying too much about getting finance and a place to put your finances.

1. Look For The Right Types Of Financial Services Available

A great way to seek financial services is to look for the right types of financial services available.

- Cannabis Business Loans: You can explore private lending companies if you want more cash in your business. Some offer loans for equipment purchases, inventory management, payroll, etc.

- Cannabis-Friendly Banks: Work with cannabis-friendly banks, if you want a place to put your money. These banks already service cannabis companies and abide by strict regulations in Maryland. Not all banks service regulated companies, but some have found a way to serve with highly regulated guidelines.

- Seek Financial Investment: Another way is to seek an investor to supply you with the financial cash your business needs to thrive.

- Crowdfunding: To get more money in your business, you can seek crowdfunding that allows the public to fund if they see your product as high quality and useful.

These are some of the available financial services you can get for your dispensary. Make sure the loans and banks you seek follow Maryland’s cannabis regulations to keep your business from getting into trouble.

2. Choose The Right Financial Expert

You can also choose the right financial expert to do all the heavy lifting for you and guide you in making the right choices to avoid financial problems in the industry.

The expert must be credible and know the cannabis industry regulations, especially in Maryland. They should have specific expertise in your local state and follow the best accounting guidelines.

At Green Space Accounting, we are cannabis experts in the industry and know the regulatory landscape in Maryland and beyond. We help companies like your dispensary with finances to help grow the business.

3. Follow Compliance Regulations In Maryland

Following compliance regulations in Maryland can sustain your business operations and keep you from receiving criminal fees and unnecessary fines.

Things like recording your inventory for tax season is important to stay compliant with taxes. Without an accurate recording of this; it can lead to consequences that your business doesn’t need.

Maryland has its regulations so it’s best to research and follow the requirements for operating your dispensary in the state.

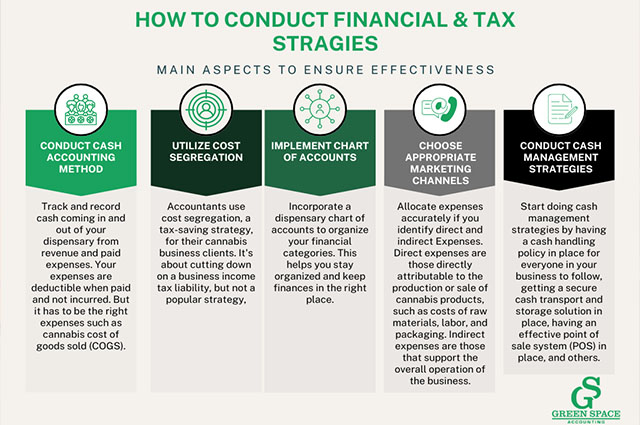

4. Conduct Financial And Tax Strategies

If you want to start doing your finances, you need to follow some financial and tax strategies.

Here are some:

- Cash Accounting Method: You track and record cash coming in and out of your dispensary from revenue and paid expenses. Your expenses are deductible when paid and not incurred. But it has to be the right expenses such as cannabis cost of goods sold (COGS). This is any direct labor costs associated with cultivating and growing cannabis plants that include soil, water, seeds, electricity, harvest, and preparation.

- Utilize Cost Segregation: Accountants use cost segregation, a tax-saving strategy, for their cannabis business clients. It’s about cutting down on a business income tax liability, but not a popular strategy that the IRS likes.

- Implement Chart Of Accounts: Incorporate a dispensary chart of accounts to organize your financial categories. This helps you stay organized and keep finances in the right place.

- Allocate Expenses: You can allocate expenses accurately if you identify direct and indirect Expenses. Direct expenses are those directly attributable to the production or sale of cannabis products, such as costs of raw materials, labor, and packaging. Indirect expenses are those that support the overall operation of the business but are not directly tied to production, such as rent, utilities, and administrative salaries.

- Conduct Cash Management Strategies: Start doing cash management strategies by having a cash handling policy in place for everyone in your business to follow, getting a secure cash transport and storage solution in place, having an effective point of sale system (POS) in place, and others.

These are a few strategies you can use to start conducting the proper financial tasks in your cannabis dispensary.

How Cannabis Accountants Help Your Dispensary Financially

Cannabis accountants can guide you in making the right financial decisions and offer ways to get financing. They make sure your finances are stable and look for hidden opportunities.

Cannabis accountants can look at your finances and see what needs improving, along with ensuring your business is compliant at all levels.

Maintaining compliance is a cannabis accountant’s primary goal for any dispensary, including yours.

At Green Space Accounting, we help ensure your business follows Maryland regulations and minimize the risk of accruing fines, especially around tax season.

Why Dispensaries Need Specialized Financial Services

If you own a dispensary, you need specialized financial services on cannabis and not just non-industry financial services.

A cannabis expert can help you navigate the regulatory landscape and offer risk management strategies to keep your business afloat.

Here are some benefits to think about:

- Maintain Regulatory Compliance

- Helps Manage Dispensary Cash Only Dealings

- Mitigates Tax Challenges

- Offers Alternative Banking Solutions

- Accurately Keep Track Of Financial Planning And Reporting

You need these specialized financial services to ensure effective financial planning and reporting.

What Your Dispensary Should Do Next

Now you’ve understood why you need specialized financial services, it’s time to identify your next steps.

- Start by looking at the best reputable financial services in Maryland and seek a cannabis accountant who has in-depth expertise in the industry, like us at Green Space Accounting.

- If you’re looking to do the financing yourself, then get familiar with the cannabis IRS tax regulations and your state’s regulations to see what your dispensary can and can’t do financially.

- Also, ask around your network and find qualified experts who know the lay of the land and can provide you with immense knowledge.

- Make up a spreadsheet of all your finances or use compliant accounting software. The accounting software can help you alleviate some of the financial complexities and give you a good place to set up your finances. These can be Bookkeep, 365 Cannabis, Distru, and Freshbooks, just to name a few.

With these resources, your business is off to a good start.

Getting A Handle On Financial Services In Maryland For Dispensaries

Finding the right financial services in Maryland can optimize your dispensary finances, provide banking solutions, and create opportunities to maximize your dollar

Cannabis accountants can provide the financial services that your dispensary needs to thrive within the regulatory market.

Maximize Your Finances Today With Cannabis Accounting Experts

Maximize your finances today by working with us at Green Space Accounting. We are cannabis experts who know how to navigate the legal complexities of the industry and offer cash management strategies, payroll solutions, and compliant services to your dispensary.

Book a consultation now to speak with an accountant for Free.