Did you know a company called Trulieve received $113 million in 280e tax refunds? The company was doing its due diligence and applying what the IRC 280e code recommends to cannabis owners.

Receiving that amount of refunds means, you need to know how to navigate the tax complexities and look for opportunities for growth to get the most money back into your business.

The journey to embark on the tax adventure isn’t easy, but finding worthy experts offering tax services helps your business stay on track and scale further in the industry.

This guide is about how cannabis tax services help your business by manuvering through regulations, minimizing tax liabilities, and looking for tax strategies for growth.

Tax Problems Cannabis Businesses Face

Cannabis businesses face tax problems mainly due to the high taxation procedures that many need to abide by. If you have a cannabis business, you need to pay more taxes than traditional businesses.

You’re taxed on more products you sell, with excise tax taking place, and you must track your inventory to ensure you record it to tax authorities, come tax season.

There are also other problems many businesses in the industry, like yourself, deal with, such as not being able to deduct normal business expenses.

If you deduct expenses you’re not supposed to deduct, this can lead to unnecessary fines and other consequences.

Aside from these problems, there’s the challenge of financial solutions to support cannabis companies that lead them to operate in cash-only transactions. This makes it harder to track, and record all necessary tax information, especially when you record finances to tax authorities.

You also need to keep everything, in order, to prepare for a tax audit since those come every once in a while to ensure your business is operating appropriately.

Though these problems seem to outweigh the positive outlook of the cannabis industry, there is a way around the tax issues that can grow your business to new heights just like Trulieve.

How To Beat The Tax Game In The Cannabis Industry

Taxes can overrun you if you don’t know how to do them while abiding by strict regulations. Knowing how to record, track, and keep your taxes in check is important to grow your business

How to do it?

Nothing is better than working with an expert cannabis accountant providing cannabis tax services due to their extensive knowledge of the industry that allows them to serve cannabis owners.

Factors To Consider When Choosing Cannabis Tax Services

- Expertise In The Industry And Taxes: An accountant can help with tax planning, tax preparation, and keeping your business from getting or accruing fines from authorities. You also can’t just work with any accountant since you should find an accountant who specializes in the cannabis industry, to grow your business.

- Reputation And Long-Track Record: Find expert accountants with a track record of helping cannabis companies.

- Cost: While cost is important, it should not be the sole factor in choosing an accountant. Instead, focus on the value that cannabis accountants offer your business. A higher fee may be worth it if the provider can save you money in the long run through effective tax planning and compliance.

- Trust And Transparency: Choose a transparent provider that reveals their fees, services, and processes.

You can also do the necessary work of taxes yourself if an accountant isn’t what you need right now. But we advise against it since it’s hard enough to operate a business, let alone manage your taxes and finances, on top of it.

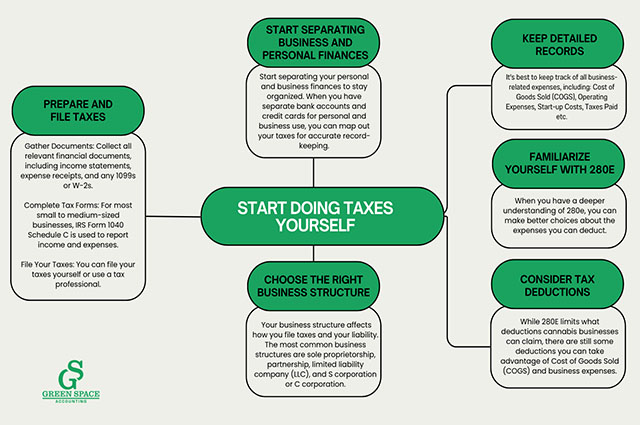

Steps To Start Doing Taxes Yourself

1. Start Separating Business And Personal Finances

Start separating your personal and business finances to stay organized. When you have separate bank accounts and credit cards for personal and business use, you can map out your taxes for accurate record-keeping.

2. Choose The Right Business Structure

Also, you should choose the right business structure to benefit from taxes. Your business structure affects how you file taxes and your liability. The most common business structures are sole proprietorship, partnership, limited liability company (LLC), and S corporation or C corporation.

3. Understand Your Tax Obligations

Different types of cannabis businesses have unique tax obligations that you need to consider including income tax, sales tax, excise tax, and employment taxes.

Here’s a breakdown of the tax obligations:

- Income Tax: Tax on the profit of your business.

- Sales Tax: Collected from customers on behalf of the state.

- Excise Tax: A federal tax on specific goods, like cannabis.

- Employment Taxes: If you have employees, you must withhold taxes from their paychecks.

Understanding these can help you determine what you need to record and track in your business, all while remaining compliant.

4. Keep Detailed Records:

You need to get an accurate record-keeping system to adhere to strict regulations and avoid possible fines.

It’s best to keep track of all business-related expenses, including:

- Cost Of Goods Sold (COGS): COGS includes the costs directly associated with the production of goods and not the actual product itself.

- Operating Expenses: Rent, utilities, salaries, etc.

- Start-Up Costs: Costs incurred before the business starts.

- Taxes Paid: Keep records of all tax payments.

Once you keep track of these records, your business operates better and minimizes risks.

5. Familiarize Yourself With 280E

It’s best to get familiar with IRC 280e since the code prohibits businesses involved in the trafficking of controlled substances, including cannabis, from deducting most normal business expenses.

When you have a deeper understanding of 280e, you can make better choices about the expenses you can deduct. This makes accurate record-keeping even more crucial for cannabis businesses.

6. Consider Tax Deductions

While 280E limits what deductions cannabis businesses can claim, there are still some deductions you can take advantage of:

- Cost Of Goods Sold (COGS): This is the most significant deduction for cannabis businesses.

- Business Expenses: Expenses, that are, not considered COGS may still be deductible, including wages, rent, and utilities.

7. Prepare And File Taxes

As a cannabis business owner, it’s recommended to work with a tax professional, especially one with experience in the cannabis industry.

Here’s a basic guide to preparing and filing your taxes

- Gather Documents: Collect all relevant financial documents, including income statements, expense receipts, and any 1099s or W-2s.

- Complete Tax Forms: For most small to medium-sized businesses, IRS Form 1040 Schedule C is used to report income and expenses.

- File Your Taxes: You can file your taxes yourself or use a tax professional.

This can help you file taxes yearly that’s ideal for staying compliant in the cannabis industry.

How Getting Tax Services Launches Your Business Forward

Finding the right tax services for your cannabis business is something you should consider if you’re not already. Tax services can give you time back into your business since you’re not worrying about taxes and finances that go with it.

Tax services from an accountant can grow your business since they look for opportunities for growth and offer the best course of action.

Cannabis accountants can also identify areas where your business can get more money back and conduct cash management strategies.

This can help your business in many ways, but let’s dive into the benefits of using cannabis tax services.

Benefits Of Using Cannabis Tax Services

There are many benefits of using cannabis tax services that we mentioned briefly above. However, we didn’t explain it in greater detail.

Here are some benefits of using cannabis tax services:

- Tax Compliance: Tax services help update your taxes to comply with compliance and regulations, especially when they change. This helps avoid penalties and fines.

- Maximize Deductions: You can maximize your deductions with tax services which give you more money in the long run.

- Save On Costs: You can save on costs since tax services can help you identify any potential tax credits and help with tax planning strategies to optimize your finances.

- Peace Of Mind: Knowing your taxes are being taken over by experts in the field can give you peace of mind. You can rest assured that your taxes are being done accurately and efficiently, allowing you to focus on other aspects of your business.

These are some of the benefits your cannabis business receives when working or using cannabis tax services.

Importance Of Keeping Your Taxes On Track In The Cannabis Industry

It’s important to keep your taxes on track in the cannabis industry to minimize any risks that your company may receive.

If your taxes aren’t done right, it can lead to other consequences, leading to higher expenses in your business.

Cannabis tax services help you stay on track and adhere to all regulatory standards set forth by regulators.

Choosing The Right Cannabis Tax Services

To choose the right cannabis tax services, you need to know what your business needs.

What are your business goals? And will hiring an accountant for tax services help you accomplish them?

These are important questions to know if you need someone to help manage your taxes and look for hidden opportunities.

You should also research the tax services individually and see if the accounting experts can help you by contacting them directly.

From there you should opt into a consultation to review your options and understand your business.

This is why we at Green Space Accounting offer a free consultation for cannabis businesses looking to handle their taxes the right way.

We deliver on our promises and offer other financial services to grow your business. Our accounting firm has been in the industry for several years and we continue to work to exceed expectations.

Book a call with us, for 30 minutes, and we can start mapping out your taxes.