Financial services offered in the cannabis industry can provide cannabis companies security or protection for their money. Many owners practice cash handling practices that can lead to exposure of their business money.

If you’re one of these business owners, you know how hard it is to handle your cash and operate in cash-only transactions.

Luckily, there are financial services offered in the cannabis industry that we will explore. So keep reading to learn more about them.

Problems Of Getting Proper Financial Services In The Industry

There’s a challenge in getting proper financial services in the industry since the cannabis legalization. We are going to dive into these problems now.

Banking Restrictions

Many financial institutions don’t want to serve cannabis companies due to restrictions surrounding the cannabis plant. Cannabis companies aren’t allowed to put their money in a bank However, current changes are being made that can turn the tables for financial institutions and cannabis banks like the SAFE banking act.

Taxation Issues (280E)

There are also taxation issues such as the IRC 280e. This code limits the deductions that cannabis companies can’t claim or report during tax season. Many traditional companies can deduct ordinary business expenses, but cannabis businesses aren’t allowed to deduct anything that relates to selling cannabis. For your cannabis, you can only deduct expenses related to inventory costs of the cannabis plant or the cannabis cost of goods sold (COGS).

Capital Access And Investment

Another problem is getting access to capital and investment for your cannabis business. Traditional funding sources such as venture capital, private equity, and institutional investors are less accessible, leading companies to rely on private investors and alternative financing methods, which can be costly and limited.

Regulatory Compliance Costs

As a cannabis owner, you’re met with costs accruing to maintain compliance in your local state. To maintain compliance, you have to start investing in accounting, legal, and operational adjustments, if you haven’t already. You need to pay these costs to avoid substantially higher fees and fines.

Market Volatility And Price Fluctuations

The market is always changing with different regulations and guidelines occurring year after year. It’s highly volatile and makes the pricing fluctuate consistently. This can pose a problem to your business finances, leading to higher costs.

Insurance Limitations

Obtaining insurance for cannabis businesses is challenging and expensive. Many insurers are hesitant to provide coverage and those that do often charge high premiums. This leaves many companies underinsured or struggling to manage the high cost of adequate coverage.

High Operating Costs

Cultivation, processing, and retail operations in the cannabis industry have high overhead costs due to the need for specialized equipment, security measures, and skilled labor. These costs can be prohibitive, especially for smaller businesses trying to scale up.

Getting Access To Safe And Effective Financial Services

Getting access to safe and effective financial services can leave your business in a better position.

There are some financial services you can access that include;

- Cannabis-Friendly Banks: There are cannabis banks that serve the industry like Safe Harbor Financial and others. If you want to know more about this, head over here to find the right bank for your business.

- Private Lenders: In the industry, you can find private lenders who serve the industry, privately. By doing your research, you can find the ones that can help your business.

- Investors: You can seek investment from investors to receive financial gains for your cannabis company.

- Funding: Another accessible financial service is funding through crowdfunding or a platform to get money for your business.

These are a few financial service options you can consider since they’re safe and effective. However, they aren’t bulletproof as the services have their own set of regulations and guidelines they need to follow. This means ensuring your cannabis company complies with your state regulations and meets the qualifications to access financial services.

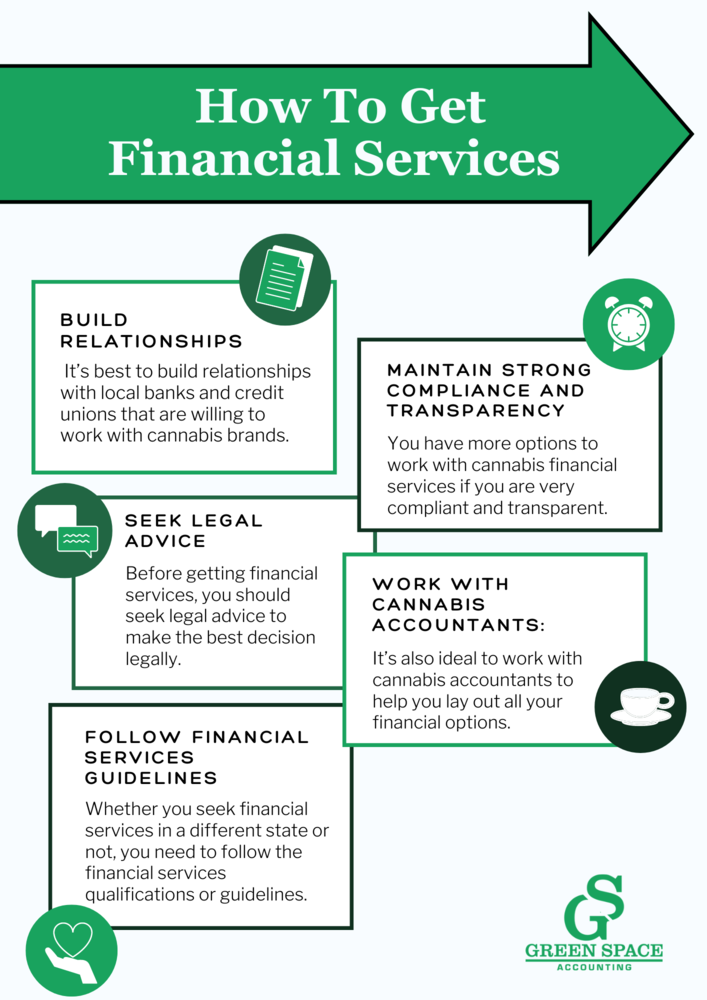

How To Get Financial Services Offered In The Cannabis Industry

Considering you need to meet certain qualifications to access financial services in the cannabis industry, we outline how you can get these services.

- Follow Financial Services Guidelines: Whether you seek financial services in a different state or not, you need to follow the financial services qualifications or guidelines

- Build Relationships: It’s best to build relationships with local banks and credit unions that are willing to work with cannabis brands. Some offer services to the cannabis industry with restrictions. You should also build relationships with lenders and meet their guidelines as well.

- Maintain Strong Compliance And Transparency: You have more options to work with cannabis financial services if you are very compliant and transparent. More are willing to work with a business that complies with the regulations to the tee.

- Seek Legal Advice: Before getting financial services, you should seek legal advice to make the best decision legally.

- Work With Cannabis Accountants: It’s also ideal to work with cannabis accountants to help you lay out all your financial options. They can help you see the financial services available for your business and optimize your finances to meet their qualifications.

If you want access to financial services, these should give you a good headstart on getting them for your business.

Start Getting Financial Services

If you don’t have the time or resources to access these financial services, you can work with a professional to help sort it out.

You can get financial services by working with cannabis accountants like Green Space Accounting.

We optimize your finances and ensure there is a solid foundation for your business to succeed. Not only that, but we ensure your business is fully compliant to meet the state’s regulations and help you make smart financial decisions.

When you work with us, we give you several financial options to ensure your business receives the funds.

Advantages Of Accessing Financial Services

There are many advantages to locating and finding financial services offered in the cannabis industry.

These include;

- Improved Security

- Efficient Operations

- Growth Opportunities

- Efficient Cash Flow Management

- Simplified Accounting

- Operational Stability

The advantages of accessing financial services can do a lot for your cannabis business that can alter your life.

Closing Thoughts

When you surpass the financial issues in the cannabis industry, it can make it easy for your business to grow and secure your money in a safe place. There are many financial services that you can look into, but knowing the right ones can give you a boost in the right direction.

Consult With Green Space Accounting Today To Get The Best Financial Services

That’s why it’s best to consult with a cannabis accountant like Green Space Accounting. We handle all your financial needs and can help you make smart financial decisions. This is especially true if you want to secure your money and optimize your finances.

Consult with Green Space Accounting by booking a call!